What’s Hiding in Your Unstructured Data?

Why it’s time to explore the untapped insights waiting to be discovered in your unstructured data.

By Lesley Boucher, Vice President of Consulting & Customer Experience, ORI

You’ve probably read these stats before—but that doesn’t make them any less astonishing:

Approximately 2.5 quintillion bytes of data are created each day—and, according to Gartner, it is estimated that 80% of all data is unstructured.

Simply put, there’s a lot of data out there—and it’s growing by the second. Specifically, the vast majority of data being generated is unstructured—meaning it either does not have a predefined data model or is not organized in a predefined manner (think open-ended survey responses, social media posts, or audio recordings). This 80% of data can be unwieldy but also immensely valuable to any organization that cares about improving member or customer experience (CX) and the bottom line.

What makes this deluge of commentary and feedback so important is that it comes directly from your customers and is brimming with insights into their experiences, wants, and needs. Your members and customers are talking—through social media, community forums, emails, chats, surveys, reviews, calls, and even your own notes—but are you listening? The insights are there, hiding in your unstructured data.

It’s easy to see why everyone is talking about unstructured data. But what is it, exactly, and why is it so important?

Differences in Data: Structured vs. Unstructured Data

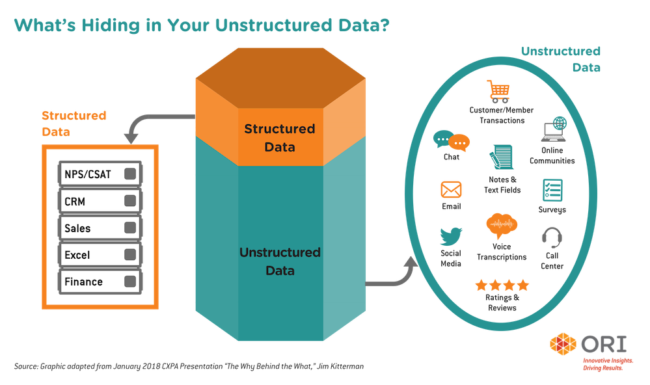

Data is typically split into two categories: structured and unstructured.

Structured data is exactly that: data that can be easily categorized and organized into neat little compartments. A universal example is data found in Excel files, neatly separated by categories and rows. Common structured data sources include customer relationship management (CRM) platforms, association management systems (AMS), Sales and Finance data, and event registrations. Structured data is standardized, making analysis of metrics like customer satisfaction (CSAT) and Net Promoter Scores (NPS) relatively easy and straightforward, as everything is organized in a similar format.

Unstructured data is where life gets interesting. By definition, it lacks standardization and often has limited preset boundaries. It is the bits and pieces gathered from documents, social media, emails, audio/visual files, open-ended response fields, notes fields, and other forms of content that is not easily boxed and analyzed using any of our standard data analytics tools. Its format may range from words or numbers to images and audio. Each time a customer, member, prospect, or stakeholder interacts with or mentions your organization or brand, they are generating unstructured data. Every organization has it, but many do not know where to begin when analyzing it.

Unstructured data is where life gets interesting. By definition, it lacks standardization and often has limited preset boundaries. It is the bits and pieces gathered from documents, social media, emails, audio/visual files, open-ended response fields, notes fields, and other forms of content that is not easily boxed and analyzed using any of our standard data analytics tools. Its format may range from words or numbers to images and audio. Each time a customer, member, prospect, or stakeholder interacts with or mentions your organization or brand, they are generating unstructured data. Every organization has it, but many do not know where to begin when analyzing it.

Because 80% of all data being created is unstructured, organizations that want to make data-driven decisions but are not exploring their unstructured data are missing out on tremendous potential. Taking advantage of current technology to efficiently analyze unstructured data provides insight into important behavioral trends. Most important, it moves you beyond “what” buyers think into “why” current and potential buyers in your marketplace are engaging with you or shifting their business elsewhere. By understanding the “why” behind the “what,” organizations are able to meet customer needs and expectations more effectively while also making strategic decisions for bottom-line impact.

Combining Unstructured Data with Structured to Turn Insights into Action

While analyzing unstructured data alone can generate valuable insights, it is most powerful when paired with structured data, such as names, contact information, and demographics. Combining structured and unstructured data provides detailed insight into trends, the particularities of individual population segments, “centers of influence” that can make or break your brand, major pain points driving lower scores, as well as areas of strength that are driving higher scores.

Leveraging all of the data collected—both structured and unstructured—ensures “systematic listening” whereby you are maximizing value from each and every customer insight data point you have. After all, if you’re only looking at 20% of the data created around your organization or brand, how confident can you be that your members and customers are satisfied enough to keep buying?

Now that we’ve covered the potential value hidden in data that you already have, how do you organize and analyze it along with your structured data to uncover actionable insights? What kinds of outcomes might you expect? Stay tuned for our next blog on mining structured and unstructured data.